#MY CHECKBOOK APP PROFESSIONAL#

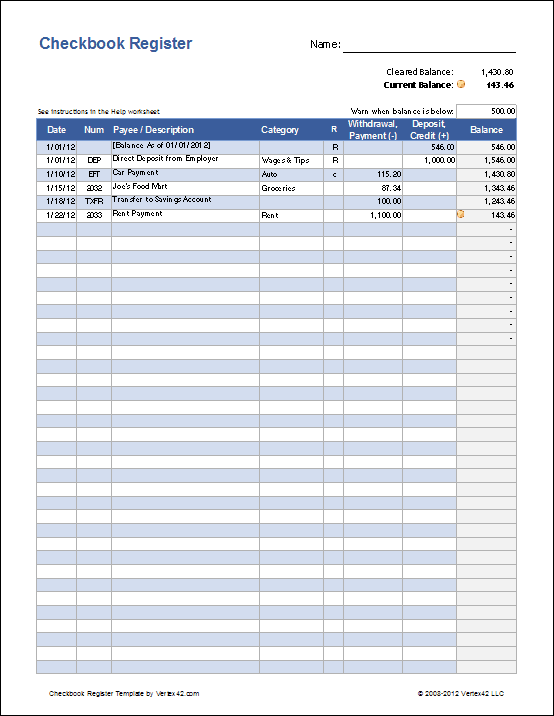

Maggie Gomez, CFP® professional and owner of Money with Maggie, says if you're recording your spending properly, you should have a better sense of how much is in your checking account, and you won't be surprised by bank transactions. Flip through your carbon copies if you forgot to list something on your checkbook register.Įven though recording these details may seem tedious, it can help you monitor your spending. Quick tip: Checkbooks come with a carbon copy, which is paper behind your check that leaves behind a copy of what you write on it. The check amount: This is how much you paid your payee.This can help keep track of your payments. The check number: Each check will have a number listed on it.The date: This is the day you wrote your check.You should at least record the following information in your checkbook register each time you write a check: The checkbook register, also known as your checkbook ledger, is the little booklet in your checkbook where you'll record all the checks you've written out. To balance a checkbook efficiently, you'll have to fill out your checkbook register routinely.

#MY CHECKBOOK APP HOW TO#

How to balance a checkbook Start by reviewing your checkbook register Quick tip: If you choose to opt out of paper statements from your bank to avoid paying a monthly fee, you may print your online statement, or scroll through it using online or mobile banking. You'll need your checkbook register, checking account statement, and a calculator. Balancing a checkbook may also help bring attention to any banking errors.īelow is a step-by-step process on how to balance your checkbook. When someone balances a checkbook, it means they're comparing a checkbook to a bank statement to review banking transactions.

What does it mean to balance a checkbook?

If you commonly use a checkbook to pay for bills, you'll want to balance it out each month to understand your spending habits. Keeping tabs on how you spend is crucial to figuring out how to implement a budgeting system that works. By clicking ‘Sign up’, you agree to receive marketing emails from InsiderĪs well as other partner offers and accept our

0 kommentar(er)

0 kommentar(er)